The grocery sales tax has long been a point of contention in Idaho. Among the states that levy a sales tax on goods, most of them have carved out exemptions for groceries. Some have called for Idaho to create a similar exemption, saying that a tax on groceries hits poor families the hardest. Libertarian groups, for whom all taxation is theft, see the grocery tax as a low-hanging fruit that might be easy to knock off.

Many voters expected some sort of action on the grocery tax when the 2022 legislative session began last month. Despite having little support in either chamber, conservative lawmakers like Reps. Ron Nate and Dorothy Moon and Sen. Christy Zito have tried multiple times to trigger a vote on exempting groceries from the sales tax. Each attempt has failed. The Legislature did, however, pass a bill that would increase the grocery tax credit from the existing $100 per person to $120 next year. The Idaho Freedom Foundation mocked this, saying it will do nothing to help working families.

But does it?

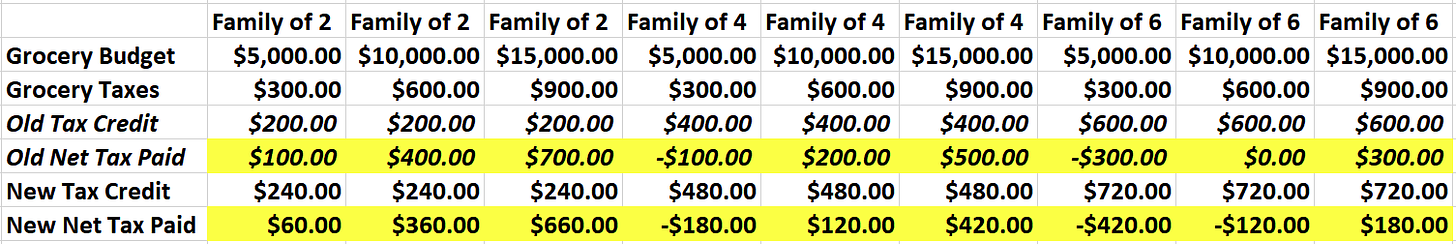

I was curious as to how the numbers actually play out in real life, so I did some math with my own situation. In 2020, my family of five spent just over $7,000 on groceries. That works out to $420 in taxes, based on Idaho’s 6% sales tax rate. When we filed our return for that year, we were given $500 in credits from the state, which means we actually received $80 more than we would have if groceries were not taxed. (I appreciate the generosity of Idaho’s taxpayers, and I promise to give back to my community in whatever way I can.)

Based on the current tax rate and credit, a childless couple becomes net taxpayers after spending $3,300 on groceries. The threshold for a family of four is around $6,600, and so on. The $20 increase per person significantly raises this threshold. A family of two can now buy $4,000 in groceries before paying more than the credit, while a family of four can buy up to $8,000. My family of six (our newest was born last year) would have to spend $12,000 on groceries before we become net taxpayers under the new threshold.

I recognize that I am surely more frugal than average, so let us look at some more numbers. What if a family of four spends $10,000 on groceries in a year? That works out to $600 in sales tax and a $400 credit. That means they paid a net of $200 in taxes on groceries. That is a mere 2% of their grocery budget, and less than $20 per month. Under the new credit, their net taxes for the year would only be $120, or a paltry $10 per month.

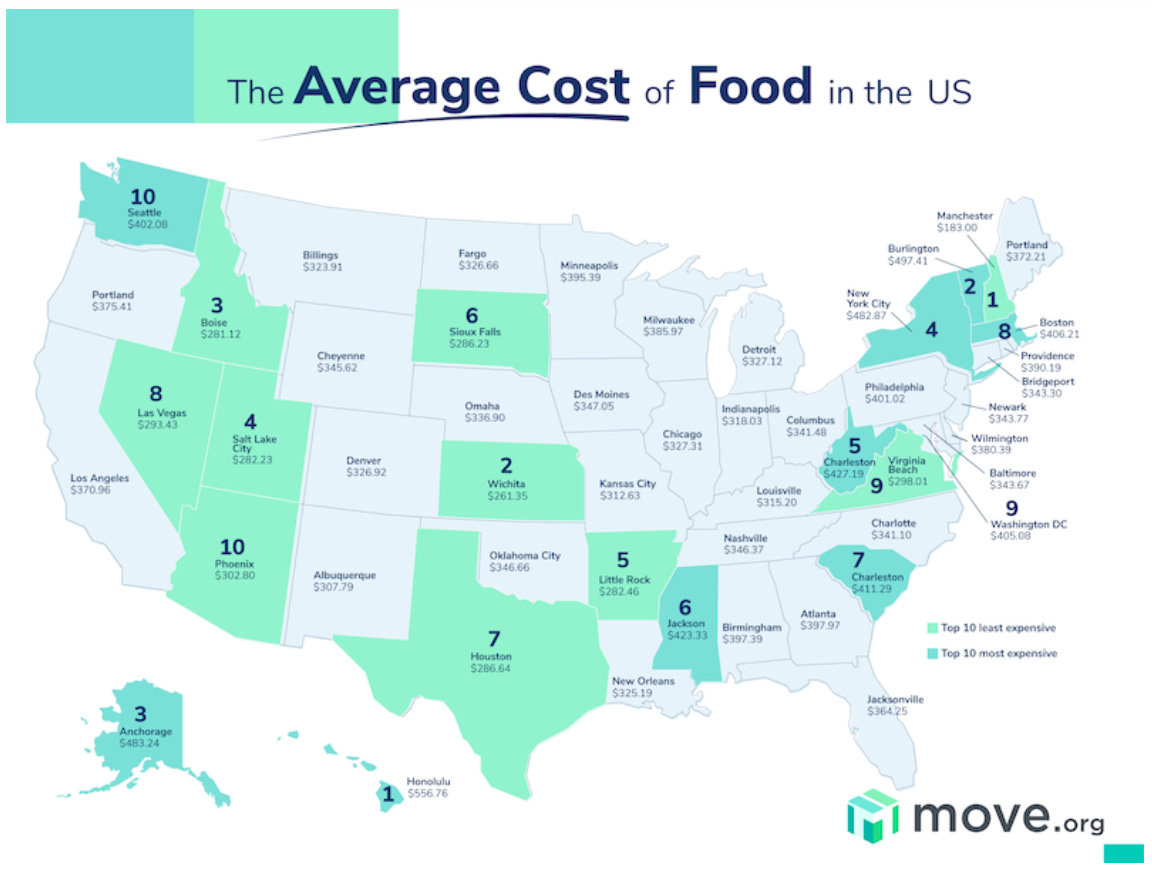

Even with a tax on groceries, Idahoans still pay much less than the national average for food, ranking near the bottom of the index:

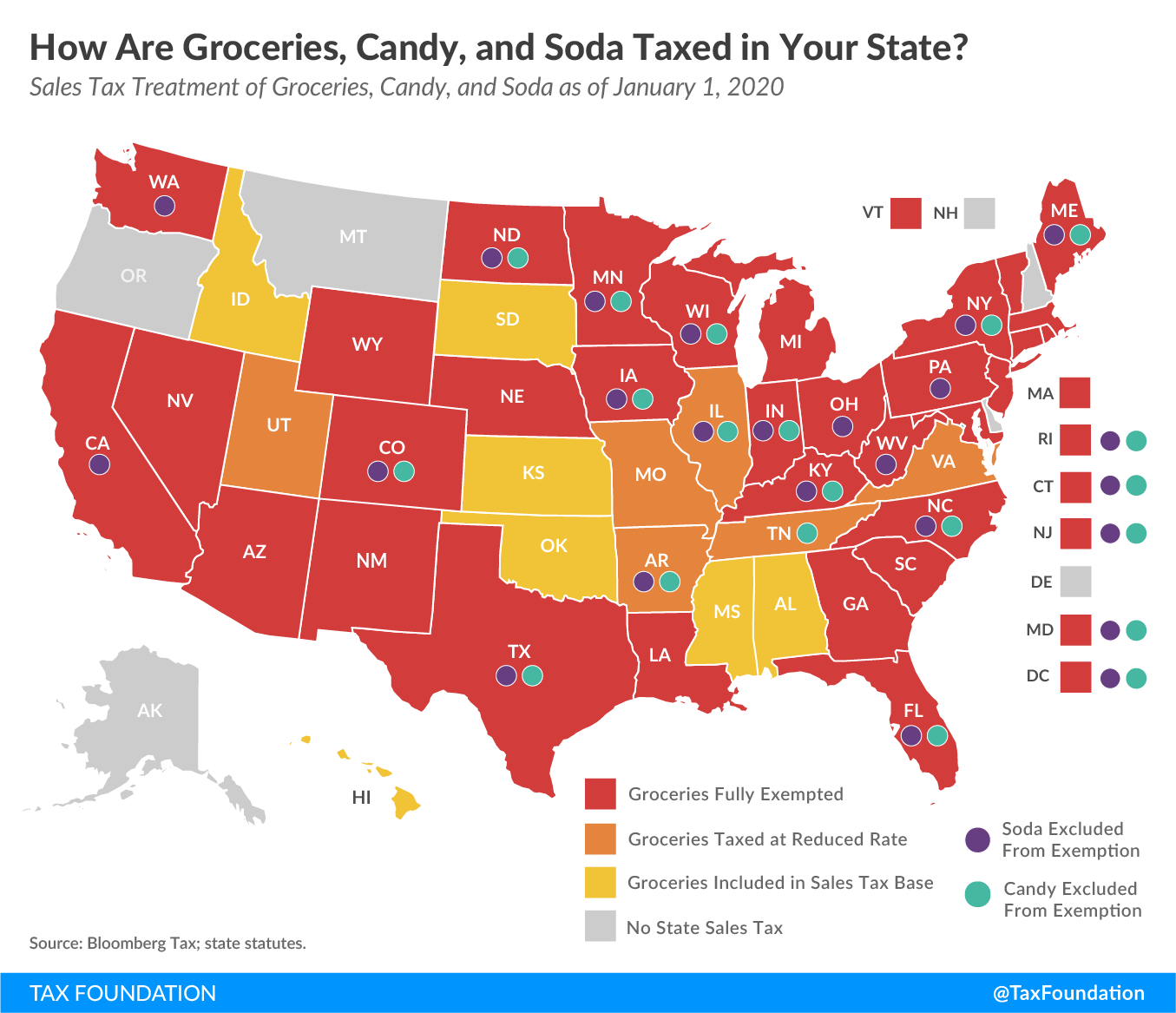

If groceries were exempted from the sales tax, that would actually mean an increase in the state bureaucracy, as someone would be tasked with decided what counts as groceries. Should soda be exempt? Most states that do not tax groceries still levy a tax on soda. What about candy? Who decides what counts as candy, anyway? Perhaps we could simply use the same list as programs such as SNAP, TANF, or WIC, but now we are entering the dangerous territory of letting government bureaucrats decide what you should be feeding your family.

Despite all this, the libertarian wing of the GOP still says we should exempt groceries from the sales tax. While I greatly respect groups like the IFF, and agree with them more often than not, I believe this is a case of misdirected energy. For the same amount of time and political capital, our elected leaders should be able to make a much bigger dent in the average Idaho family budget by reforming property taxes instead.

Could we not reform both?

Beyond what I wrote above about how little impact the grocery tax actually has, there are several reasons to leave it alone. For example, the sales tax has a much broader base than income and property taxes. Ideally, if you have to have taxes at all, they should be spread out among as many taxpayers as possible. This is a much more fair system than what the left desires. They are constantly trying to create progressive taxes which are confined to certain demographics. Our current national tax system is an example of this. The bottom 50% of the population pay little to no taxes; in fact many are actually net recipients of taxpayer dollars. This creates perverse incentives in a republic, as politicians are motivated to take more and more from a small group of voters and redistribute it to the majority.

It is the left that claims that sales taxes are bad because poor people pay a greater share of their income in such taxes than the rich. While this is mathematically true, it is an argument based on emotion rather than fact. The modus operandi of the left is to use greed and envy to drive social change. Besides, as I demonstrated above, the grocery tax credit is more than enough recompense for any family that is struggling to make ends meet.

A sales tax is more fair than income or property taxes because it is based on consumption. A consumption tax impacts those who consume, which means your own level of taxation is entirely dependent upon your behavior. You can choose to buy fewer goods, and therefore pay less in taxes. Contrast this with the income tax, that penalizes economic achievement, and the property tax, which penalizes home ownership.

Let us take a closer look at that last point. Property taxes are especially perverse things in a free society. Home ownership strongly correlates with civic engagement. A homeowner is someone who is here for the long term, who is putting down roots in his neighborhood. We want more people to buy homes, to buy land, to invest in the long-term good of their community. The point of a free country is that property rights are respected and protected by our government. Once you pay off your house, it is yours, right?

Wrong. A property tax is a permanent lien on your home in the name of the government. If you ever stop paying, whether by choice or necessity, the state can enforce that lien literally at gunpoint. How many stories have we heard of elderly men and women forced out of the homes they bought fifty years ago because the tax valuation has gone too high? Once a home has been paid off, you should not have to continue paying the government for the right to live there. We aspire to be a nation of owners, not permanent renters.

In full disclosure, I am currently renting. When I moved here, I chose to wait to get to know the area and watch the market before investing in a home. I therefore do not directly pay property taxes; they are built into my monthly rent. However, one of the reasons I left my beloved Washington state was exactly because of property taxes. King County could not get enough of our money; they were always demanding more. Our modest 1,400 square foot home in a 7,000 square foot lot was assessed for more than $4,000 in property taxes the year we decided to leave.

While the libertarian dream of zero taxation is nice, it is also unrealistic. We must therefore work with our elected leaders to decide how to structure taxes in our community. A sales tax is more equitable than the property tax, and by distributing the burden broadly it costs the average Idahoan much less. It makes sense for our representatives to focus their time and energy on reforming the property tax rather than exempting groceries from the sales tax. From what I hear from the Capitol, this is exactly what they are doing right now. Stay tuned.

The grocery tax is one of those issues that seems cut-and-dried in the headline but looks very different once you dig into the details. Proponents of an exemption are making big claims about what it could accomplish, and I might have been swayed by such appeals until I looked at the numbers myself. I hope this piece has helped clarify the issue for you as well.

time to turn the grocery tax into a benefit:

I'd rather see this turned into a BENEFIT rather than repealed. a significant benefit would be to give back to Idaho residents $300 per person (a family of four would get $1200. rebate). the rebate would be limited to a maximum income of $100,000 and then prorated up to $150,000 income with no benefit after that. this would be a way to capture all of the tourism spent in Idaho (significant). I'm quite certain that the majority of families in Idaho would fall into the $300 per person category and welcome it at the end of the year.

RE: Property tax: a very EASY way to give HOMEOWNERS (primary residence) property tax relief is increase the property tax exemption...triple it!

I concur with your point on the grocery tax. the rebate the state would give should more than cover the "normal" expenditure. For those that want to give it some thought, think about all of the big spenders that buy a lot of expensive grocery items..expensive meat cuts, etc...their "excess" if you will will provide tax income (they can afford it) and that excess income can be subsequently used to offset other taxes. Support a PROP 13 like tax that california has and california liberal politicians hate...i.e. a fixed 1 percent of purchase price based on WHEN you bought the property that cannot be increased. won't solve the big "target" you paint on your house when you can't pay it...but at least you know what it will be...